Business 101: Why Cash Flow is the Real Boss

Let’s address the elephant in the room.

Show of hands—who likes failure?

Thought so. No one starts a business dreaming of closing up shop within a year, five years, or even ten. And yet, the cold hard truth is:

23.2% of small businesses fail within their first year

48% fail within the first five

65.3% don’t make it to year ten

That’s a lot of broken dreams, a lot of burned-out founders—and in many cases, a lot of avoidable mistakes.

Now, sure—failure is part of growth. But failing without knowing why? That’s a recipe for burnout. Especially when you’re pouring your blood, sweat, and tears into a vision you believe in.

And if we’re keeping it real? Some of y’all had no business starting a business in the first place. (No shade… okay, maybe a little.)

But for those of you grinding—working late nights, wearing all the hats, doing the best you can with what you’ve got—this blog is for you.

Let’s stop you from becoming another statistic.

Why Do Most Businesses Fail?

Here’s the big one:

82% of businesses fail due to poor cash flow.

(Not profit. Not sales. Cash. Flow.)

That’s an overwhelming majority. And the causes?

Poor budgeting

Late customer payments

Inadequate financial planning

Robbing Peter to pay Paul until both accounts are dry

At the end of the day, it’s not about how much you make—it’s about how much you keep flowing in.

What is Cash Flow?

Let’s keep it simple.

Cash flow is the money that moves in and out of your business.

Imagine a cup with a tiny hole at the bottom. That’s your business.

The hole? Your expenses (they never stop leaking).

The water? Your income (coming from a faucet).

No new water = dry cup = dry business = you’re out.

So yeah, cash flow is kind of a big deal.

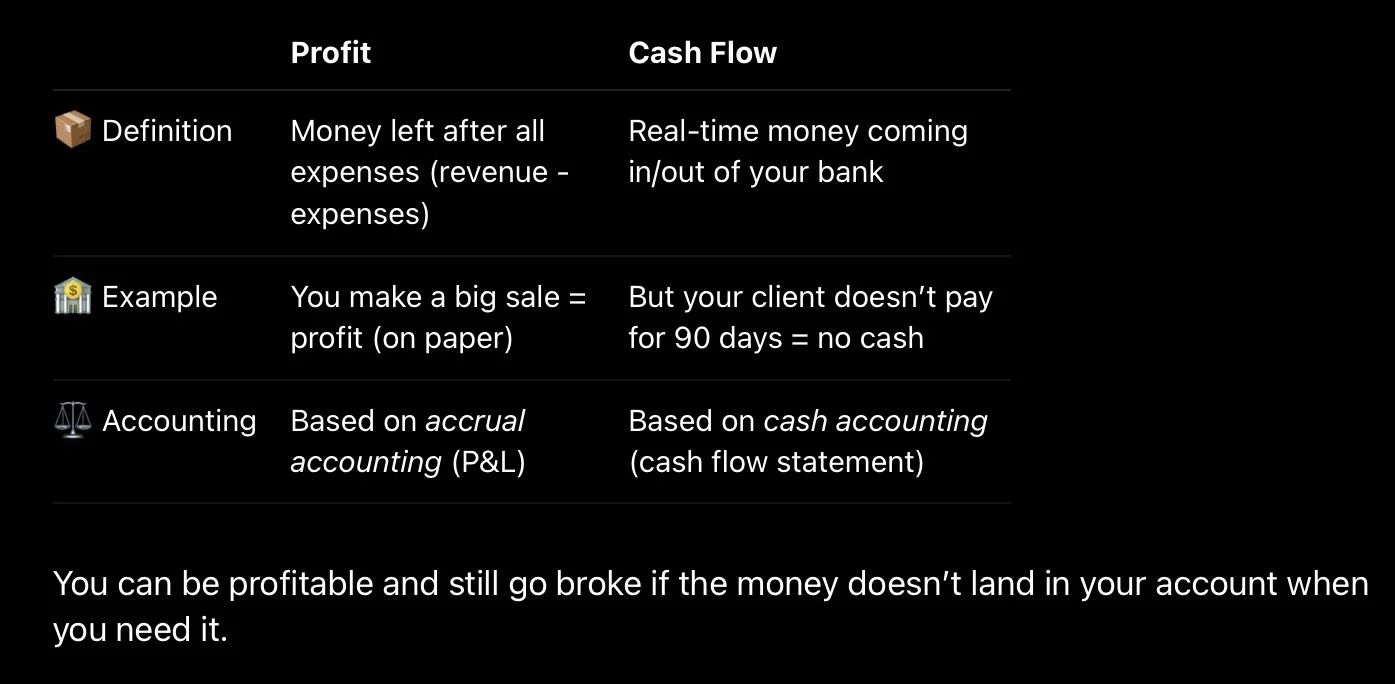

Profit ≠ Cash Flow

Let’s set the record straight.

The 3 Types of Cash Flow

Cash flow is broken down into three types on your statement of cash flows:

1. Operating Cash Flow

This is your day-to-day.

💼 From selling goods or services

💳 Includes things like payroll, rent, utilities, customer payments

Formula:

Net income + Non-cash expenses + Changes in working capital

2. Investing Cash Flow

This is the big picture stuff.

🏗️ Cash used to buy or sell long-term assets (equipment, property, etc.)

Buy new equipment = cash outflow

Sell equipment = cash inflow

3. Financing Cash Flow

This is the money tied to how you fund your business.

💰 Loans, credit, or investments

💸 Loan proceeds = inflow

🧾 Loan repayments = outflow

💵 Paying dividends = outflow

What’s a Cash Flow Statement?

A cash flow statement (aka statement of cash) shows you how money moved in and out of your business over time.

It pulls from:

The income statement (aka profit & loss)

The balance sheet

Formula:

Cash Flow Statement = Income Statement + Balance Sheet

It helps you:

Track if you have enough to cover bills

Forecast dry spells

Make smarter decisions with your money

Positive vs. Negative Cash Flow

Positive Cash Flow: You’re bringing in more than you spend

Negative Cash Flow: You’re spending more than you earn (😬)

Your goal? Stay cash flow positive.

That’s what pays your bills, buys new inventory, fuels growth, and avoids those scary “we might not make payroll” moments.

How to Analyze & Improve Your Cash Flow

So… how do you know if your cash flow is healthy? Here’s how:

1. Create a Cash Flow Statement

Don’t have accounting software? No worries.

Use your income statement + balance sheet

Break down into: Operating / Investing / Financing flows

2. Spot the Trends

Look for:

Late payments from customers

High-cost subscriptions draining funds

Excess inventory sitting too long

High debt payments dragging down your bottom line

3. Improve the Flow

Small tweaks = big change

Cut wasteful expenses (bye, unused software)

Speed up receivables (tighten payment terms)

Negotiate vendor terms

Refinance or restructure debt

Sell unused equipment

4. Monitor Free Cash Flow

Free cash flow = operating cash flow - capital expenditures

This number tells you how much you really have left over to:

Reinvest in growth

Pay yourself

Handle emergencies

5. Set Goals

Set goals around:

Collecting cash faster

Decreasing unnecessary outflows

Aligning cash strategy with your business vision

Don’t Confuse Revenue for Resilience

Just because the sales are coming in doesn’t mean your business is healthy.

Cash is king. But cash flow? Cash flow is queen. And she moves the board.

Get serious about it.

My Final Word to You

If you’re here, you’re probably:

A start-up owner

A seasoned vet

A business barely hanging on

Or someone who’s already shut their doors and trying to figure out what went wrong

No matter where you are in your journey…

Don’t let cash flow kill your dream.

Need help?

You don’t have to do this alone.

If you’re confused, overwhelmed, or just need a friendly expert to peek at your numbers…

📞 Let’s hop on a call.

Book a FREE consultation here:

👉 https://calendly.com/nate-exumebookkeeping/15min-bookkeeping-consultation

Let’s build smarter businesses. One cash flow at a time.

— Nate

Summary:

82% of small businesses fail due to cash flow issues

Cash flow ≠ profit: it’s about when money enters/exits

Three types of cash flow: operating, investing, financing

You must know your cash flow to grow your business

A cash flow statement shows your financial oxygen levels

Positive cash flow pays the bills, not just profit

Analyzing and improving cash flow requires tracking, adjustments, and strategy

Free cash flow = true spendable money after operations

Setting cash flow goals = future-proofing your business